What is Happening to House Prices in 2021

The mini boom of last year may be back. After seeing three consecutive months of falling house prices we have now recently experienced five positive months in a row. Different to the previous lockdown of 2020 the property market is open for business, normal social distancing rules apply and viewings from prospective property buyers can still commence. In addition surveyors are still able to carry out their normal duties and if any remedial work is required builders and workman are still be allowed to visit your home. At Direct House Buyer you’ll be pleased to know that our we buy any house service will also continue as normal during this 2021 lockdown and we are not experiencing delays. Information on moving house and conducting property viewings can be found here.

What has Happened to House Prices in Recent Times

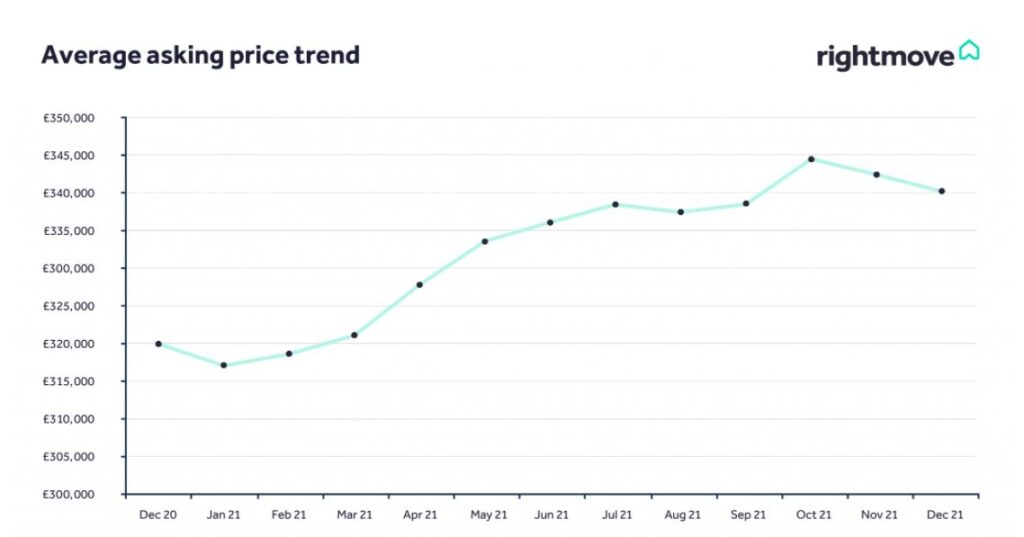

Data taken from the Rightmove house price index shows:

- December 2021 – £340,167

- November 2021 – £342,401

- October 2021 – £344,445

- September 2021 – £338,462

- August 2021 – £337,371

- July 2021 – £338,447

- June 2021 – £336,073

- May 2021 – £333,564

- April 2021 – £327,797

- March 2021 – £321,064

- February 2021 – £318,580

- January 2021 – £317,058

Since March 2020 when the impact of Coronavirus first hit property prices have risen a average 13.2% across the UK.

Why did Prices not Fall in the First Lockdown

During the first wave of coronavirus the property market was forced shut and it effectively froze property prices in a stagnate moment of time. It turns out that this benefited and protected house prices from any form of panic selling. By the time the property market was re-opened and buyers and sellers were able to start negotiating the government had introduced schemes that protected jobs, protected people from defaulting on loans and their mortgages, provided furlough income and notably a stamp duty scheme was announced that unexpectedly created a mini boom, with people rushing to take advantage of the tax saving.

What will Happen to House Prices when Furlough Schemes End

Employees are still receiving furlough and a fourth SEISS grant will be paid to the self employed towards the end of April 2021. Inevitably, at some point the governments income support will come to an end. It was recently announced that the economy contracted 9.9% the largest annual fall in hundreds of years. It is also apparent that when the National Lockdown is lifted and furlough is no longer provided then many people may have no job to go back to. With no income to pay their mortgage and lenders being allowed to repossess homes as may happen after April 1st, home owners may be forced to sell their house quickly and lower their asking price so that they can free themselves from financial obligations that they can no longer afford.

Stamp Duty Relief has now Ended

The end of the Stamp Duty tax relief scheme could see the first removal of fiscal measures that have helped prop up the property market during these uncertain times. The scheme has effectively ended with just a small saving of up to £2500 that was offered until October 1st 2021.

First Time Buyers will receive Help to Buy on New Build Houses Only

During April the government launched a new Help to Buy scheme which many would think is fantastic for the property market. However, there is one factor which could be detrimental for those who are wishing to sell their house. The latest Help to Buy scheme only applies to new build homes, meaning those who are wishing to sell their existing home will be left out the picture. Prospective first time home buyers will now have their interest diverted towards buying a new build home, meaning there will be less buyers available. We may see sellers having to reduce their asking prices to make their house more attractive and fall more within the first time buyer price bracket.