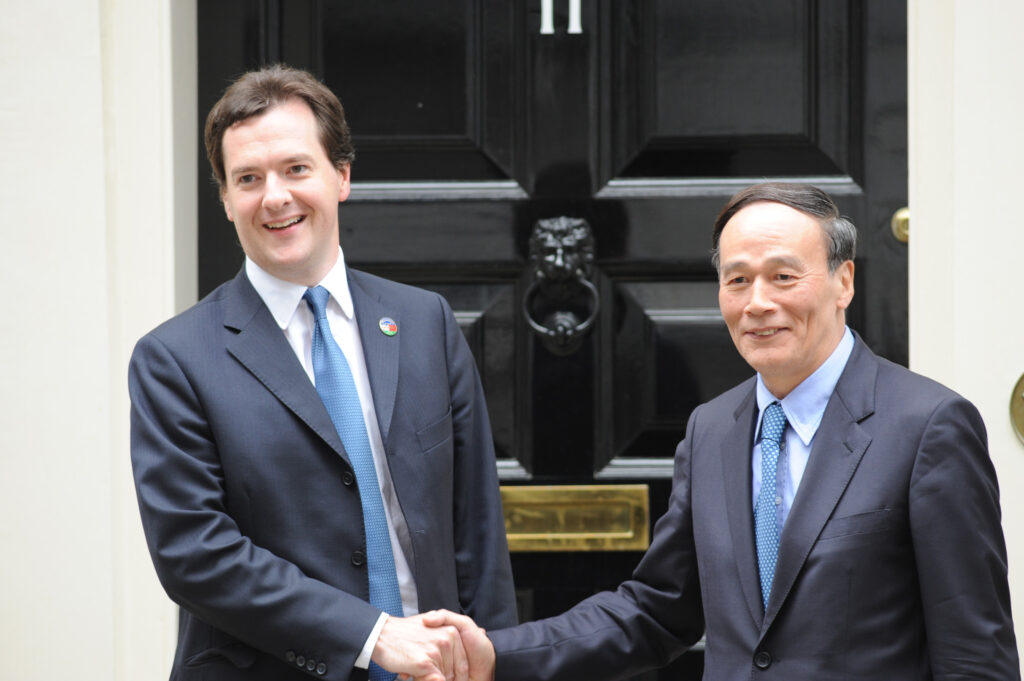

George Osborne Cuts Tax Allowance for Landlords

In today’s budget George Osborne has cut the tax relief that landlords have benefited from for many years. Up until now landlords have been able to offset the amount they pay in Interest on their buy to let mortgages against their income tax bill. Meaning that many landlords have had to pay hardly any tax and those who have large property portfolios have benefited even more. For smaller landlords who are in the basic rate of income tax they may remain unaffected.

Will this force Landlords to Sell their Property

As property owners will now be forced t pay more tax they may decide that now is a good time to sell their investments. If a large amount of Landlords decide to sell at the same time the supply squeeze that we are currently experiencing may ease and house prices may start to fall. At the same time if there are less buy to let properties available tenants may find themselves having to pay even more rent as there will be less rental to choose from.

Is this the End of the Buy to Let Boom

The Buy to Let boom has been one of the main factors for why we have experienced such price increases across the whole market. Buy to Let mortgages are approved according to the rental value of the property and are treated as a business by lenders which is different to the approval for residential mortgages as they are approved upon an individuals income. Essentially Buy to Let mortgages have created a imbalance in society and have made homes more unaffordable for your normal residential house buyer. It’s probably not the end for the Buy to Let market and some more drastic measures such has limiting the amount of buy to let properties someone can own or far tougher mortgage criteria would probably readdress the balance and help make homes more affordable for your average house buyer.